salt tax cap news

House Democrats are making a last-ditch bid to reverse the 10000 cap on state and local tax deductions before years end. Raising the SALT cap from 10000 to 80000 would almost exclusively benefit the highest 20 of tax filers who are households earning more than 175000 a year according to an analysis Thursday.

Most New York Times Matt Dorfman Design Illustration Illustration Design Newspaper Design Health Magazine Layout

The SALT deduction tends to benefit states with many higher-earners and higher state taxes.

. But theyll likely need to renew their efforts in 2020 -- or beyond -- because the legislation has no chance of becoming law this year. The lawmakers have asked the US. The House-passed version of.

The so-called SALT tax cap imposed a 10000 limit on IRS deductions for state and local taxes like income and capital gains levies and property taxes. Both Gottheimer and Suozzi have been some of the most vocal advocates for SALT playing a pivotal role in getting the language to increase the cap from 10000 to 80000 into the House-passed. The TCJA reduced the corporate tax rate from.

And while its presently due to sunset in 2025 Suozzi should. The current Democrat-controlled House passed a bill in 2021 that would temporarily raise the cap to 80000 until 2031 when it would go back to 10000. As a result the percentage of taxpayers claiming the deduction fell by nearly two-thirds while the average amount claimed fell by 80 percent.

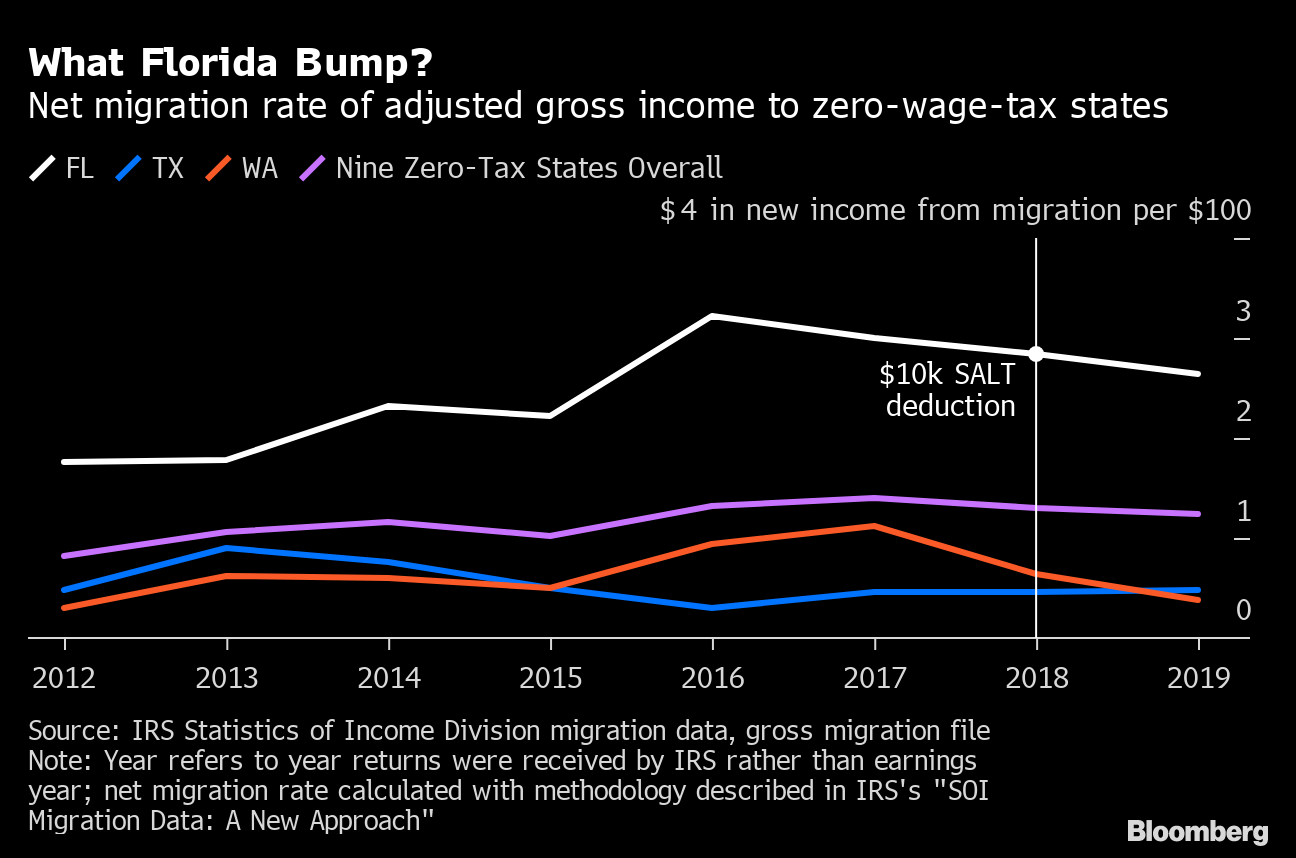

Seven statesCalifornia New York Texas New Jersey Maryland Illinois and Floridaclaimed more than half of the value of all SALT deductions nationwide in 2018. The cap on the SALT deduction started in 2018 because of the Tax Cuts and Jobs Act a tax reform passed in 2017. In 2017 during the Trump Administration the Tax Cuts and Jobs Act TCJA raised the amount of the standard deduction.

Senate Democrats say a proposal to raise the cap on state and local tax SALT deductions a top priority of Senate Majority Leader Charles Schumer D-NY is likely to be cut from the revised. For details on California and several other state laws see ongoing updates to my June 22 2021 blog post Unlock State Local Tax Deductions With A SALT Cap Workaround. The relaxed cap an increase from the current 10000 limit would last for a decade until 2031.

To help pay for that increase SALT deductions were capped at 10 000 per. This was true prior to the SALT deduction cap and remained the case in 2018. The SALT deal appeared to remove one obstacle to passing the sprawling 19 trillion spending plan.

This cap remains unchanged for your 2021 taxes and it will remain the same in 2022 if Congress doesnt remove the cap in its spending bill. While the House package raises the SALT deduction limit to 80000 through 2030 negotiations are ongoing in the Senate with concerns over. Heres an example.

The Supreme Court on Monday declined to review a challenge to the 10000 ceiling imposed on the state and local tax SALT deduction one of the most controversial provisions of the 2017 tax bill. The deduction cap should be fully eliminated but Hill haggling may just raise it to a higher number say 15000 or 20000. The SALT cap blocks taxpayers from deducting more than 10000 per year in their state and local taxes when itemizing federal deductions.

As he said Monday about the repeal of the SALT cap If it doesnt happen I will look like an idiot. Trumps 2017 tax cut capped the previously unlimited SALT deduction at 10000 hurting taxpayers who itemize their deductions especially those in high-tax states. At least hes trying.

December 12 2021 930 AM 4 min read. Learn about excise tax and how Avalara can help you manage it across multiple states. Not in these quarters.

The latest SALT plan would remove the current 10000 cap part of the 2017 tax overhaul entirely for those making less than 400000 a year. Ad Find out what excise tax applies to and how to manage compliance with Avalara. In 2021 Joe Trader pays 35000 of state income taxes on the S-Corp level using a SALT cap workaround.

His S-Corp net income is 500000 subject to a state tax rate of 7. Republicans created the 10000 cap on SALT deductions as a means to offset the cost of their other tax cuts in the 2017 Tax Cuts and Jobs Act TCJA. 2018 analysis showed 752000 Californians earning less than 250000 a year paid an additional 1 billion in federal taxes thanks to the SALT cap.

It wasnt until ten paragraphs into the report that NBC News acknowledges the SALT provisions would give two-thirds of people making more than a million dollars a tax cut Ina Coolbrith Park. Democrats have forged a compromise to. Three House Democrats are still pushing for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT.

According to the Tax Policy Center 16 of tax filers with income between 20000 and 50000 claimed the SALT deduction in 2017 compared to 76 for tax filers with income between 100000 and. However for tax years 2018 through 2025 the TCJA capped the SALT deduction at 10000 for single taxpayers and couples filing jointly limiting its value for tax filers. The SALT benefit was capped at 10000 in the 2017 Republican tax law and many Democrats come from areas where the average amount of tax paid far exceeds that limit.

52 rows The deduction has a cap of 5000 if your filing status is married filing separately.

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Gaming The Salt Cap May Be Congress S Worst Tax Idea Of The Year

Salt Deduction Biden S Spending Bill Why A Flat Tax Should Be Considered Steve Forbes Forbes Youtube

Salt Cap Confounds Doomsayers As Fears Of Exodus Prove Overblown Bloomberg

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

Calls To End Salt Deduction Cap Threaten Passage Of Biden S Tax Plan

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

House Democrats Propose Increasing Salt Cap To 72 500 Through 2031

Higher Tax Rates For Billionaires And Corporations Can Still Fund Biden S Agenda

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

Salt Tax Repealed By House Democrats The Washington Post

Why This Tax Provision Puts Democrats In A Tough Place Time

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version